Life Insurance in and around Moultrie

Protection for those you care about

Life happens. Don't wait.

Would you like to create a personalized life quote?

Protect Those You Love Most

You might think you don’t need to worry about life insurance while you are young. Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Moultrie, GA, friends and neighbors of all ages already have State Farm life insurance!

Protection for those you care about

Life happens. Don't wait.

Put Those Worries To Rest

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the cost associated with raising children, life insurance is strictly vital for young families. Even for parents who stay home, the costs of finding other ways to cover housekeeping or daycare can be significant. For those who aren't raising a family, you may have debt that your partner will have to pay or be financially responsible to business partners.

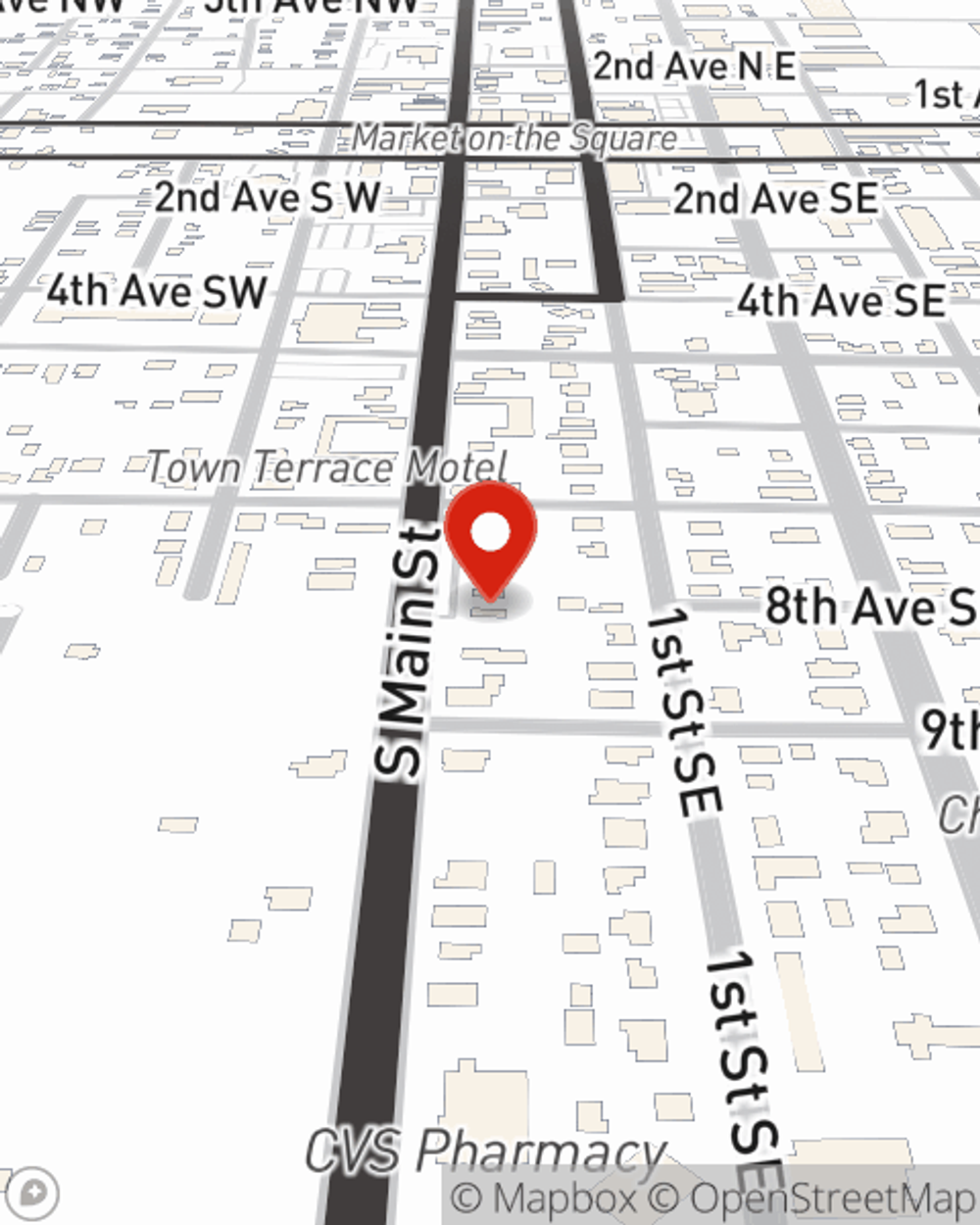

As a value-driven provider of life insurance in Moultrie, GA, State Farm is ready to protect those you love most. Call State Farm agent Sharon DeMott today for a free quote on a life insurance policy.

Have More Questions About Life Insurance?

Call Sharon at (229) 985-6262 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

Sharon DeMott

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®